Rare earth mining may be key to our renewable energy future. But at what cost?

We take you inside Mountain Pass, the only rare earth mine in the United States.

Mountain Pass (shown), in southeastern California, remains the United States’ only mine for rare earth elements, the building blocks of magnets used in smartphones, wind turbines and electric vehicles.

TMY350/WIKIMEDIA COMMONS (CC BY-SA 4.0)

In spring 1949, three prospectors armed with Geiger counters set out to hunt for treasure in the arid mountains of southern Nevada and southeastern California.

In the previous century, those mountains yielded gold, silver, copper and cobalt. But the men were looking for a different kind of treasure: uranium. The world was emerging from World War II and careening into the Cold War. The United States needed uranium to build its nuclear weapons arsenal. Mining homegrown sources became a matter of national security.

After weeks of searching, the trio hit what they thought was pay dirt. Their instruments detected intense radioactivity in brownish-red veins of ore exposed in a rocky outcrop within California’s Clark Mountain Range. But instead of uranium, the brownish-red stuff turned out to be bastnaesite, a mineral bearing fluorine, carbon and 17 curious elements known collectively as rare earths. Traces of radioactive thorium, also in the ore, had set the Geiger counters pinging.

As disappointing as that must have been, the bastnaesite still held value, and the prospectors sold their claim to the Molybdenum Corporation of America, later called Molycorp. The company was interested in mining the rare earths. During the mid-20th century, rare earth elements were becoming useful in a variety of ways: Cerium, for example, was the basis for a glass-polishing powder and europium lent luminescence to recently invented color television screens and fluorescent lamps.

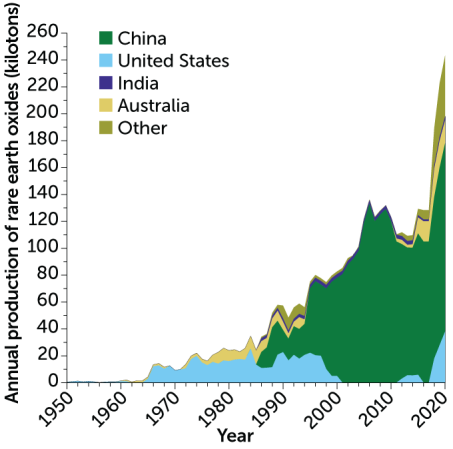

For the next few decades, the site, later dubbed Mountain Pass mine, was the world’s top source for rare earth elements, until two pressures became too much. By the late 1980s, China was intensively mining its own rare earths — and selling them at lower prices. And a series of toxic waste spills at Mountain Pass brought production at the struggling mine to a halt in 2002.

But that wasn’t the end of the story. The green-tech revolution of the 21st century brought new attention to Mountain Pass, which later reopened and remains the only U.S. mine for rare earths.

Rare earths are now integral to the manufacture of many carbon-neutral technologies — plus a whole host of tools that move the modern world. These elements are the building blocks of small, superefficient permanent magnets that keep smartphones buzzing, wind turbines spinning, electric vehicles zooming and more.

Mining U.S. sources of rare earth elements, President Joe Biden’s administration stated in February 2021, is a matter of national security.

Rare earths are not actually rare on Earth, but they tend to be scattered throughout the crust at low concentrations. And the ore alone is worth relatively little without the complex, often environmentally hazardous processing involved in converting the ore into a usable form, says Julie Klinger, a geographer at the University of Delaware in Newark. As a result, the rare earth mining industry is wrestling with a legacy of environmental problems.

Rare earths are mined by digging vast open pits in the ground, which can contaminate the environment and disrupt ecosystems. When poorly regulated, mining can produce wastewater ponds filled with acids, heavy metals and radioactive material that might leak into groundwater. Processing the raw ore into a form useful to make magnets and other tech is a lengthy effort that takes large amounts of water and potentially toxic chemicals, and produces voluminous waste.

“We need rare earth elements … to help us with the transition to a climate-safe future,” says Michele Bustamante, a sustainability researcher at the Natural Resources Defense Council in Washington, D.C. Yet “everything that we do when we’re mining is impactful environmentally,” Bustamante says.

But there are ways to reduce mining’s footprint, says Thomas Lograsso, a metallurgist at the Ames National Laboratory in Iowa and the director of the Critical Materials Institute, a Department of Energy research center. Researchers are investigating everything from reducing the amount of waste produced during the ore processing to improving the efficiency of rare earth element separation, which can also cut down on the amount of toxic waste. Scientists are also testing alternatives to mining, such as recycling rare earths from old electronics or recovering them from coal waste.

Much of this research is in partnership with the mining industry, whose buy-in is key, Lograsso says. Mining companies have to be willing to invest in making changes. “We want to make sure that the science and innovations that we do are driven by industry needs, so that we’re not here developing solutions that nobody really wants,” he says.

Klinger says she’s cautiously optimistic that the rare earth mining industry can become less polluting and more sustainable, if such solutions are widely adopted. “A lot of gains come from the low-hanging fruit,” she says. Even basic hardware upgrades to improve insulation can reduce the fuel required to reach the high temperatures needed for some processing. “You do what you [can].”

The environmental impact of rare earth mining

Between the jagged peaks of California’s Clark range and the Nevada border sits a broad, flat, shimmering valley known as the Ivanpah Dry Lake. Some 8,000 years ago, the valley held water year-round. Today, like many such playas in the Mojave Desert, the lake is ephemeral, winking into appearance only after an intense rain and flash flooding. It’s a beautiful, stark place, home to endangered desert tortoises and rare desert plants like Mojave milkweed.

From about 1984 to 1998, the Ivanpah Dry Lake was also a holding pen for wastewater piped in from Mountain Pass. The wastewater was a by-product of chemical processing to concentrate the rare earth elements in the mined rock, making it more marketable to companies that could then extract those elements to make specific products. Via a buried pipeline, the mine sent wastewater to evaporation ponds about 23 kilometers away, in and around the dry lake bed.

The pipeline repeatedly ruptured over the years. At least 60 separate spills dumped an estimated 2,000 metric tons of wastewater containing radioactive thorium into the valley. Federal officials feared that local residents and visitors to the nearby Mojave National Preserve might be at risk of exposure to that thorium, which could lead to increased risk of lung, pancreatic and other cancers.

Unocal Corporation, which had acquired Molycorp in 1977, was ordered to clean up the spill in 1997, and the company paid over $1.4 million in fines and settlements. Chemical processing of the raw ore ground to a halt. Mining operations stopped shortly afterward.

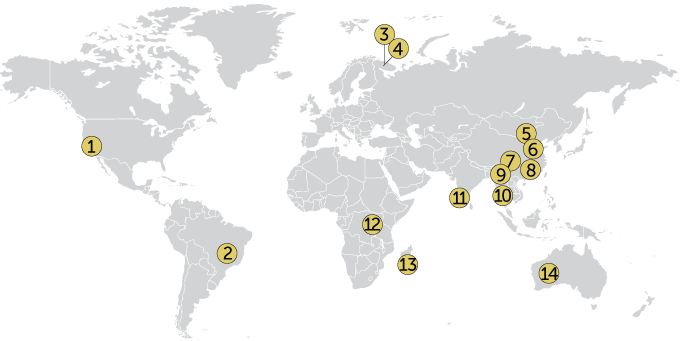

Half a world away, another environmental disaster was unfolding. The vast majority — between 80 and 90 percent — of rare earth elements on the market since the 1990s have come from China. One site alone, the massive Bayan Obo mine in Inner Mongolia, accounted for 45 percent of rare earth production in 2019.

Bayan Obo spans some 4,800 hectares, about half the size of Florida’s Walt Disney World resort. It is also one of the most heavily polluted places on Earth. Clearing the land to dig for ore meant removing vegetation in an area already prone to desertification, allowing the Gobi Desert to creep southward.

In 2010, officials in the nearby city of Baotou noted that radioactive, arsenic- and fluorine-containing mine waste, or tailings, was being dumped on farmland and into local water supplies, as well as into the nearby Yellow River. The air was polluted by fumes and toxic dust that reduced visibility. Residents complained of nausea, dizziness, migraines and arthritis. Some had skin lesions and discolored teeth, signs of prolonged exposure to arsenic; others exhibited signs of brittle bones, indications of skeletal fluorosis, Klinger says.

The country’s rare earth industry was causing “severe damage to the ecological environment,” China’s State Council wrote in 2010. The release of heavy metals and other pollutants during mining led to “the destruction of vegetation and pollution of surface water, groundwater and farmland.” The “excessive rare earth mining,” the council wrote, led to landslides and clogged rivers.

Faced with these mounting environmental disasters, as well as fears that it was depleting its rare earth resources too rapidly, China slashed its export of the elements in 2010 by 40 percent. The new limits sent prices soaring and kicked off concern around the globe that China had too tight of a stranglehold on these must-have elements. That, in turn, sparked investment in rare earth mining elsewhere.

In 2010, there were few other places mining rare earths, with only minimal production from India, Brazil and Malaysia. A new mine in remote Western Australia came online in 2011, owned by mining company Lynas. The company dug into fossilized lava preserved within an ancient volcano called Mount Weld.

Mount Weld didn’t have anywhere near the same sort of environmental impact seen in China: Its location was too remote and the mine was just a fraction of the size of Bayan Obo, according to Saleem Ali, an environmental planner at the University of Delaware. The United States, meanwhile, was eager to once again have its own source of rare earths — and Mountain Pass was still the best prospect.

Mountain Pass mine gets revived

After the Ivanpah Dry Lake mess, the Mountain Pass mine changed hands again. Chevron purchased it in 2005, but did not resume operations. Then, in 2008, a newly formed company called Molycorp Minerals purchased the mine with ambitious plans to create a complete rare earth supply chain in the United States.

The goal was not just mining and processing ore, but also separating out the desirable elements and even manufacturing them into magnets. Currently, the separations and magnet manufacturing are done overseas, mostly in China. The company also proposed a plan to avoid spilling wastewater into nearby fragile habitats. Molycorp resumed mining, and introduced a “dry tailings” process — a method to squeeze 85 percent of the water out of its mine waste, forming a thick paste. The company would then store the immobilized, pasty residue in lined pits on its own land and recycle the water back into the facility.

Unfortunately, Molycorp “was an epic debacle” from a business perspective, says Matt Sloustcher, senior vice president of communications and policy at MP Materials, current owner of Mountain Pass mine. Mismanagement ultimately led Molycorp to file for Chapter 11 bankruptcy in 2015. MP Materials bought the mine in 2017 and resumed mining later that year. By 2022, Mountain Pass mine was producing 15 percent of the world’s rare earths.

MP Materials, too, has an ambitious agenda with plans to create a complete supply chain. And the company is determined not to repeat the mistakes of its predecessors. “We have a world-class … unbelievable deposit, an untapped potential,” says Michael Rosenthal, MP Materials’ chief operating officer. “We want to support a robust and diverse U.S. supply chain, be the magnetics champion in the U.S.”

The challenges of separating rare earths

On a hot morning in August, Sloustcher stands at the edge of the Mountain Pass mine, a giant hole in the ground, 800 meters across and up to 183 meters deep, big enough to be visible from space. It’s an impressive sight, and a good vantage point from which to describe a vision for the future. He points out the various buildings: where the ore is crushed and ground, where the ground rocks are chemically treated to slough off as much non–rare earth material as possible, and where the water is squeezed from that waste and the waste is placed into lined ponds.

The end result is a highly concentrated rare earth oxide ore — still nowhere near the magnet-making stage. But the company has a three-stage plan “to restore the full rare earth supply to the United States,” from “mine to magnet,” Rosenthal says. Stage 1, begun in 2017, was to restart mining, crushing and concentrating the ore. Stage 2 will culminate in the chemical separation of the rare earth elements. And stage 3 will be magnet production, he says.

Since coming online in 2017, MP Materials has shipped its concentrated ore to China for the next steps, including the arduous, hazardous process of separating the elements from one another. But in November, the company announced to investors that it had begun the preliminary steps for stage 2, a “major milestone” on the way to realizing its mine-to-magnet ambitions.

With investments from the U.S. Department of Defense, the company is building two separations facilities. One plant will pull out lighter rare earth elements — those with smaller atomic numbers, including neodymium and praseodymium, both of which are key ingredients in the permanent magnets that power electric vehicles and many consumer electronics. MP Materials has additional grant money from the DOD to design and build a second processing plant to split apart the heavier rare earth elements such as dysprosium, also an ingredient in magnets, and yttrium, used to make superconductors and lasers.

Like stage 2, stage 3 is already under way. In 2022, the company broke ground in Fort Worth, Texas, for a facility to produce neodymium magnets. And it inked a deal with General Motors to supply those magnets for electric vehicle motors.

But separating the elements comes with its own set of environmental concerns.

The process is difficult and leads to lots of waste. Rare earth elements are extremely similar chemically, which means they tend to stick together. Forcing them apart requires multiple sequential steps and a variety of powerful solvents to separate them one by one. Caustic sodium hydroxide causes cerium to drop out of the mix, for example. Other steps involve solutions containing organic molecules called ligands, which have a powerful thirst for metal atoms. The ligands can selectively bind to particular rare earth elements and pull them out of the mix.

But one of the biggest issues plaguing this extraction process is its inefficiency, says Santa Jansone-Popova, an organic chemist at Oak Ridge National Laboratory in Tennessee. The scavenging of these metals is slow and imperfect, and companies have to go through a lot of extraction steps to get a sufficiently marketable amount of the elements. With the current chemical methods, “you need many, many, many stages in order to achieve the desired separation,” Jansone-Popova says. That makes the whole process “more complex, more expensive, and [it] produces more waste.”

Under the aegis of the DOE’s Critical Materials Institute, Jansone-Popova and her colleagues have been hunting for a way to make the process more efficient, eliminating many of those steps. In 2022, the researchers identified a ligand that they say is much more efficient at snagging certain rare earths than the ligands now used in the industry. Industry partners are on board to try out the new process this year, she says.

In addition to concerns about heavy metals and other toxic materials in the waste, there are lingering worries about the potential impacts of radioactivity on human health. The trouble is that there is still only limited epidemiological evidence of the impact of rare earth mining on human and environmental health, according to Ali, and much of that evidence is related to the toxicity of heavy metals such as arsenic. It’s also not clear, he says, how much of the concerns over radioactive waste are scientifically supported, due to the low concentration of radioactive elements in mined rare earths.

Such concerns get international attention, however. In 2019, protests erupted in Malaysia over what activists called “a mountain of toxic waste,” about 1.5 million metric tons, produced by a rare earth separation facility near the Malaysian city of Kuantan. The facility is owned by Lynas, which ships its rare earth ore from Australia’s Mount Weld to the site. To dissolve the rare earths, the ore is cooked with sulfuric acid and then diluted with water. The residue that’s left behind can contain traces of radioactive thorium.

Lynas had no permanent storage for the waste, piling it up in hills near Kuantan instead. But the alarm over the potential radioactivity in those hills may be exaggerated, experts say. Lynas reports that workers at the site are exposed to less than 1.05 millisieverts per year, far below the radiation exposure threshold for workers of 20 millisieverts set by the International Atomic Energy Agency.

“There’s a lot of misinformation about byproducts such as thorium.… The thorium from rare earth processing is actually very low-level radiation,” Ali says. “As someone who has been a committed environmentalist, I feel right now that there’s not much science-based decision making on these things.”

Given the concerns over new mining, environmental think tanks like the World Resources Institute have been calling for more recycling of existing rare earth materials to reduce the need for new mining and processing.

“The path to the future has to do with getting the most out of what we take out of the ground,” says Bustamante, of the NRDC. “Ultimately the biggest lever for change is not in the mining itself, but in the manufacturing, and what we do with those materials at the end of life.”

That means using mined resources as efficiently as possible, but also recycling rare earths out of already existing materials. Getting more out of these materials can reduce the overall environmental impacts of the mining itself, she adds.

That is a worthwhile goal, but recycling isn’t a silver bullet, Ali says. For one thing, there aren’t enough spent rare earth–laden batteries and other materials available at the moment for recycling. “Some mining will be necessary, [because] right now we don’t have the stock.” And that supply problem, he adds, will only grow as demand increases.