Gene Genies, Green Cement, Blue’s Clues and Gray’s Anatomy

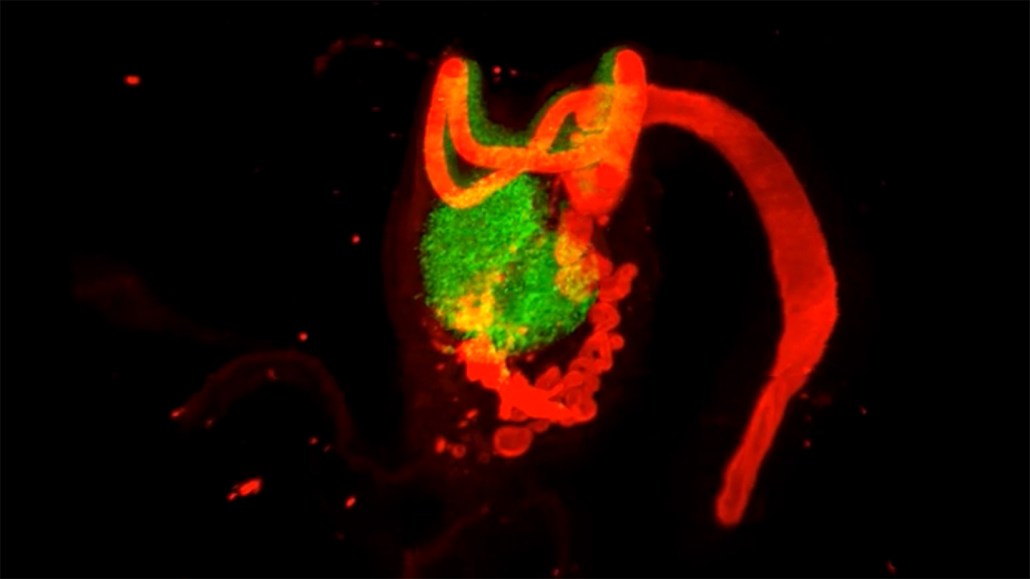

The rete ovarii (in red) extends from the ovary, curving around the organ like a horseshoe.

D. Anbarci et al/eLife 2025

By Susanna Camp

🥚Ovaries: Not just for eggs anymore

A previously overlooked function of the ovary could birth new innovation in the world of fertility. Meghan Willcoxon explores the discovery in a recent issue of Science News.

🧲The horseshoe factor: the rete ovarii

For years, we’ve primarily seen ovaries as the powerhouses of egg production and hormone release (think estrogen and progesterone, long tapped for their use in fertility treatments, birth control, and hormone replacement therapies). In research in mice, developmental biologist Jennifer McKey at the University of Colorado in Aurora and colleagues shine a light on the rete ovarii. This horseshoe-shaped appendage was first described over a century ago and shown in early drawings in Gray’s Anatomy, and then dismissed as functionless and ignored until now. McKey’s team’s rediscovery may have implications for women’s reproductive health treatments.

💉Fertility Frontiers

This discovery cracks open some intriguing commercial possibilities. For fertility startups, understanding more about the structure of the ovary could lead to innovative diagnostic tools and treatments. Improving IVF success rates or addressing unexplained infertility would be a game-changer. The ability to influence the local immune environment in the reproductive tract could be a further bonus.

Pharmaceutical companies involved in both fertility and birth control could find new paths to drug development. Fertility drugs that enhance this positive immune-ovary crosstalk could boost healthy pregnancy rates. Understanding how to disrupt these signals locally could lead to novel, targeted contraceptives with potentially fewer systemic side effects. Companies focusing on autoimmune diseases might also find this research relevant, given the ovary’s newly discovered role in immune system regulation.

🌳Fertile Ground for Investment: Startups to Watch

While pinpointing specific startups already applying this very new research might be premature, the broader fertility tech space is bursting with innovation. Here are a few companies that are likely to be early adopters of any breakthroughs in ovarian function understanding:

- Gameto is a female-led biotech company based in New York City. Its lead product Fertilo offers in vitro maturation (a potential enhancement to in vitro fertilization) in which eggs are ripened outside the uterus with ovarian “support” cells derived from stem cells. The product is currently in advanced clinical trials, and has raised $73 million to date, most recently through a $33 million Series B in May 2024.

- Celmatix is a preclinical-stage biotech firm based in New York City and Cambridge, Mass.. Therapies in their pipeline address ovarian aging and infertility, and include a non-hormonal immunotherapy for endometriosis. With total funding of $57 million, the company received a $3.5 million grant from the Advanced Research Projects Agency for Health (ARPA-H) for early-stage research efforts.

- Overture Life based in Madrid, Spain and Coral Gables, Florida, aims to automate IVF lab procedures like egg and embryo freezing and sperm injection. They’ve raised a total of $37 million in funding to date, including from London-based Octopus Ventures (one of Europe’s largest and most active early-stage investors) Google Ventures, Khosla Ventures, and Salesforce’s Marc Benioff.

A Sea Change for Cement? Decarbonizing Construction

Can we harvest the ocean’s natural resources to form the building blocks of our cities? SN’s Carolyn Gramling explores a groundbreaking approach to cement production that could shrink the industry’s massive carbon footprint — and potentially reshape the future of construction.

🌊From Seawater to Solid Ground: The Science Explained

Cement production contributes 8% of the world’s total CO2 emissions. Traditional methods require the mining of mountains, riverbeds and the ocean floor to gather the raw material components mixed to create cement. A new method developed by researchers at Northwestern University takes a different approach, swapping the non-renewable sources for seawater. The team partnered with cement manufacturer Cemex’s innovation development branch to zap seawater with electricity to split its molecules while injecting CO2 into the mix. The process generates hydrogen gas, chlorine gas and oxygen, and also produces some minerals, including calcium carbonate, the primary raw material for cement manufacture.

🪨A Concrete Opportunity: Commercial Implications

The potential payoff for green cement is enormous. The global market for cement is projected to grow from $506 billion in 2024 to $686 billion by 2032, driven by increasing demands for residential, commercial, industrial, and infrastructure developments. Consider these implications:

- Reduced Carbon Footprint: Construction projects could become greener, helping institutions meet ambitious sustainability goals.

- New Revenue Streams: Companies that adopt greener technologies could gain a competitive advantage and attract environmentally conscious investors and clients.

- Infrastructure Resilience: Seawater and waste CO2 are abundant, providing raw materials even in regions with limited access to traditional resources.

- Green Building Materials: Availability of green cement could spur innovation in sustainable building.

🏦Financial Landscape: Cemex and Startups

- Cemex (NYSE: CX), the Mexican company featured in the study, is one of the world’s largest cement producers, with an $8 billion market cap. The company has ambitious goals to become a net-zero CO2 company by 2050, so we can expect to see more investment in sustainable innovations and partnerships with scientists and startups.

- ReefCycle is an early-stage Raleigh, N.C. biotech startup that uses plant enzymes to mimic natural shell formation, creating a durable and marine-safe bio-cement without depleting resources. Since its founding last year, the company has attracted capital that preserves founders’ equity, from organizations such as IDEO’s Climate Resiliency Challenge, the Dutch foundation What Design Can Do, and the Biomimicry Institute’s Ray of Hope Accelerator. The founders are currently raising an angel funding round with strategic partners.

- Cambridge Electric Cement, based in Cambridge, England, is a sustainable cement startup with a total of $2.3 million in investment. Its process co-recycles steel and cement to produce a low carbon, circular cement product.

Here’s hoping we can build the future on green cement!

The Emotional Lives of Our Furry Friends

We all have empathy for our pets and other animals, but research covered by Gennaro Tomma for SN shows we don’t always read their cues right, especially when we lack context. Conversely, accurate readings of a dog’s emotional state set the conditions for improved welfare decisions. The difficulty lies in separating correct interpretations from human biases.

🗞️Behind the news: Blue’s Clues

Animal welfare scientist Holly Molinaro of Arizona State University’s Canine Science Collaboratory research lab tested undergraduates’ abilities to gauge a dog’s mood, based on edited video footage of the dog on a black background, with all environmental context removed. On average, participants could not tell the difference between positive and negative moods. Only when shown unedited video, which included information about environment, could the subjects accurately determine whether the dog was playing or agitated. The conclusion? Humans are not good at reading their pets’ behaviors.

⛑️AI to the rescue

If you’re interested in products and services that cater to pets’ emotional well-being, not just their physical needs, there’s a growing market out there. This includes AI-powered tools that their developers say can detect and interpret dog moods, leading to more personalized care.

🐶Companies to Watch:

- Traini: This Palo Alto–based startup is developing AI-powered tools, including a smart collar that analyzes barks and behaviors in real-time. They’ve raised seed and pre-seed funding of over $3 million.

- Companion: Based in San Francisco, this startup has developed an AI-powered device that analyzes dog behavior and body language and offers interactive engagement and training. They have secured over $14 million in funding, indicating strong investor confidence in this space.

Our prediction: the market for pet-related products and services is already massive, so whoever cracks the code on catering to emotional well-being will be the top dog.

Decoding the DNA Drama: 23andMe Navigates Choppy Waters

The personal genomics giant 23andMe has officially entered Chapter 11 bankruptcy, as reported by SN’s Tina Hesman Saey. Let’s delve into what this means for the industry and where savvy investors might find their next promising sequence.

🧬Behind the Breakdown: A Tangled Strand

Rocked by a 2023 data breach exposing about 7 million users’ genetic and health information, the firm lost trust and significant funds. More than 50 class-action lawsuits ensued, contributing to ongoing struggles to achieve sustained profitability. The company is seeking a buyout of its assets, leaving the future of its vast genetic database — the very core of its value — in the balance. It’s a stark reminder of the complexities and sensitivities surrounding personal genetic information.

Since the company’s launch in 2006, scientists have used 23andMe data to identify genetic associations with various diseases, understand the genetic basis of traits, and apply these findings to developmental research. The company’s data has been used to identify genetic variants linked to conditions like Parkinson’s, preterm birth, vulnerability to common infections, and schizophrenia. 23andMe has also partnered with other organizations, including drug companies like GSK (which put $300 million into the company in 2018), to identify genetic markers for conditions like depression and to develop new medicines.

👶Opportunity Breeds

While 23andMe navigates this restructuring, the demand for personal genetic insights isn’t going anywhere. In fact, the market is ripe for competitors who can build trust, prioritize data security, and offer compelling value propositions.

🧞The Gene Genies to Watch:

- AncestryDNA: Founded in 1983 as a genealogy database, Ancestry is now the largest for-profit genealogy company in the world, with reported annual revenue of over $1 billion, 65 billion records and 27 million subscribers in the network.

- MyHeritage: This Israeli company offers DNA tests and genealogy reporting, along with health risk and carrier screening. MyHeritage was acquired in early 2021 by Francisco Partners for $600 million. Since then, they have announced additional acquisitions. Their platform is available in 42 languages.

- Nebula Genomics: Founded in 2016 by the legendary Harvard genetics professor George Church and two researchers from his lab, Nebula Genomics attracted early investment from Khosla Ventures and was later acquired by ProPhase Labs, Inc. (Nasdaq: PRPH). With offices in San Francisco and Boston, Nebula’s model uses blockchain to ensure data privacy, and aims to accelerate drug development, streamline clinical trials, and usher in an era of personalized medicine.

- SelfDecode, founded in Florida in 2014, raised $8 million in 2021 in equity crowdfunding from a WeFunder campaign for its home DNA kits and AI-powered platform that provides personalized health recommendations based on an individual’s DNA, lab results and environment.

The upshot: if you’re in the market either for genetic testing or investing, look for competitors who are prioritizing data security, building trust with consumers, and offering differentiated value through deeper analysis or unique features. In the meantime, bear in mind that HIPAA laws don’t govern genetic data, so your privacy may be at risk if any of your family members have ever subscribed to 23andMe. In case you need it, here’s how to delete your data.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Society for Science and Science News Media Group assumes no liability for any financial decisions or losses resulting from the use of the content in this newsletter. Society for Science and Science News Media Group do not receive payments from, and do not have any ownership or investment interest in, the companies mentioned in this newsletter. Please consult a qualified financial advisor before making any investment decisions.