Business firms range in size from boutiques operated by individuals to huge multinational corporations employing thousands. You would expect that there are fewer large businesses than small ones. In economics, however, it’s useful to characterize the size distribution of firms more precisely than that. Within an industry, for example, the firm size distribution would indicate the degree of industrial concentration–a quantity that might be of interest in setting antitrust policy.

To determine the firm size distribution in the United States, Robert L. Axtell of the Brookings Institution in Washington, D.C., turned to data gathered in 1997 by the U.S. Census Bureau. Equating size with number of employees and analyzing data for about 5.5 million U.S. tax-paying companies, he discovered that, for each 10-fold increase in size, the number of firms was roughly one-tenth as large. Axtell reported his findings in the Sept. 7 Science.

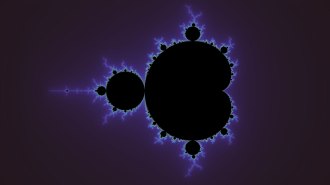

The relationship that Axtell found is an example of a scaling or power law. In this case, the probability that a firm is larger than size s is inversely proportion to s.

This specific relationship is often termed the Zipf distribution, named for linguist George Kingsley Zipf (1902–1950). Zipf had observed that such an inverse relationship holds for the frequency of English words when the number of occurrences is plotted as a function of the rank. (See http://hobart.cs.umass.edu/~allan/cs646-f97/char_of_text.html for several examples.)

Interestingly, Axtell found that the Zipf distribution held even when firms with zero employees (self-employed individuals) were included in his analysis. Moreover, the inverse relationship remained largely unchanged from year to year over a 10-year span, even as the number of firms and total employees each increased, as did the average firm size.

“Individual firms migrated up and down the Zipf distribution, but economic forces seem to have rendered any systematic deviations for it short-lived,” Axtell said.

Why does such a distribution hold so robustly for U.S. firms?

Axtell has developed an agent-based computer model of social interactions in which firms form through the collaboration of individuals. In this model, workers seek a balance between income and leisure under the assumption that more income means less leisure. At the same time, they organize themselves into teams because, on larger scales, there is greater productivity for the same amount of effort.

In this simulated world, “individual firms grow and perish, there is perpetual adaptation and change at the micro-level, and the composition of each firm at any instant is path-dependent,” Axtell remarked in a preprint describing his model. Remarkably, the firm sizes that emerged from this relatively crude and simplistic model followed a power-law (or, more specifically, Zipf) distribution.

Axtell’s model, which emphasized interactions between individuals with different characteristics and the collective behavior that emerges as a result, provides an intriguing, though simplified picture of the evolution of firms. Firms are typically founded by agents who prefer income to leisure, Axtell said. Over time, agents with a comparatively greater preference for leisure join these firms. The number of “free riders” also grows while the most productive agents begin to leave. Firms eventually collapse.

On the agent scale, individuals tend to move from firm to firm, staying in one place an average of 3 to 4 years. Income-loving agents tend to work in larger firms. Permitting agents to display “loyalty” to their firms generally produces larger firms.

The most successful firms, Axtell suggested, appear to be the ones that can attract and retain the most productive workers rather than those that aim for the highest profit margins in the short term.