Nudging people to make good choices can backfire

Choice architects like to prod us to save for retirement and eat healthier

NUDGE BACKLASH Nudging people to make good choices, about their retirement plans, charitable giving or even preventive health care, does not always go as planned.

David Curtis

Nudges are a growth industry. Inspired by a popular line of psychological research and introduced in a best-selling book a decade ago, these inexpensive behavior changers are currently on a roll.

Policy makers throughout the world, guided by behavioral scientists, are devising ways to steer people toward decisions deemed to be in their best interests. These simple interventions don’t force, teach or openly encourage anyone to do anything. Instead, they nudge, exploiting for good — at least from the policy makers’ perspective — mental tendencies that can sometimes lead us astray.

But new research suggests that low-cost nudges aimed at helping the masses have drawbacks. Even simple interventions that work at first can lead to unintended complications, creating headaches for nudgers and nudgees alike.

Nudge proponents, an influential group of psychologists and economists known as behavioral economists, follow a philosophy they dub libertarian paternalism. This seemingly contradictory phrase refers to a paternalistic desire to promote certain decisions via tactics that preserve each person’s freedom of choice. Self-designated “choice architects” design nudges to protect us from inclinations that might not serve us well, such as overconfidence, limited attention, a focus on now rather than later, the tendency to be more motivated by losses than gains and intuitive flights of fancy.

University of Chicago economist Richard Thaler and law professor Cass Sunstein, now at Harvard University, triggered this policy movement with their 2008 book Nudge. Thaler and Sunstein argued that people think less like an economist’s vision of a coldly rational, self-advancing Homo economicus than like TV’s bumbling, doughnut-obsessed Homer Simpson.

Choice architects like to prod with e-mail messages, for example, reminding a charity’s past donors that it’s time to give or telling tardy taxpayers that most of their neighbors or business peers have paid on time. To nudge healthier eating, these architects redesign cafeterias so that fruits and vegetables are easier to reach than junk food.

A popular nudge tactic consists of automatically enrolling people in organ-donation programs and retirement savings plans while allowing them to opt out if they want. Until recently, default choices for such programs left people out unless they took steps to join up. For organ donation, the nudge makes a difference: Rates of participation typically exceed 90 percent of adults in countries with opt-out policies and often fall below 15 percent in opt-in countries, which require explicit consent.

Promising results of dozens of nudge initiatives appear in two government reports issued last September. One came from the White House, which released the second annual report of its Social and Behavioral Sciences Team. The other came from the United Kingdom’s Behavioural Insights Team. Created by the British government in 2010, the U.K. group is often referred to as the Nudge Unit.

In a September 20, 2016, Bloomberg View column, Sunstein said the new reports show that nudges work, but often increase by only a few percentage points the number of people who, say, receive government benefits or comply with tax laws. He called on choice architects to tackle bigger challenges, such as finding ways to nudge people out of poverty or into higher education.

Missing from Sunstein’s comments and from the government reports, however, was any mention of a growing conviction among some researchers that well-intentioned nudges can have negative as well as positive effects. Accepting automatic enrollment in a company’s savings plan, for example, can later lead to regret among people who change jobs frequently or who realize too late that a default savings rate was set too low for their retirement needs. E-mail reminders to donate to a charity may work at first, but annoy recipients into unsubscribing from the donor list.

“I don’t want to get rid of nudges, but we’ve been a bit too optimistic in applying them to public policy,” says behavioral economist Mette Trier Damgaard of Aarhus University in Denmark.

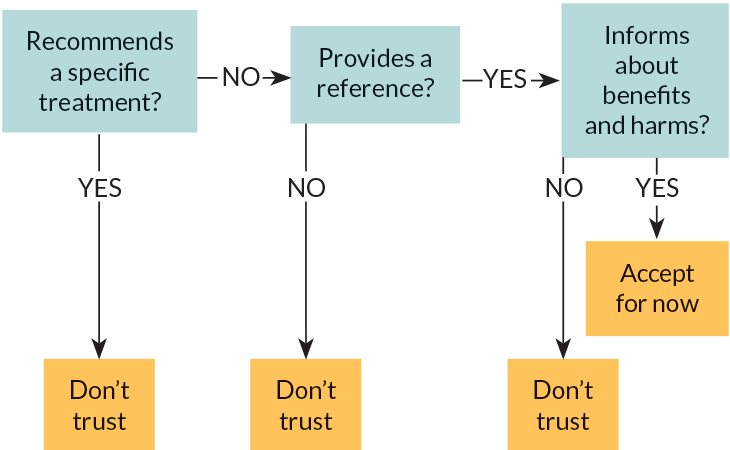

Nudges, like medications for physical ailments, require careful evaluation of intended and unintended effects before being approved, she says. Policy makers need to know when and with whom an intervention works well enough to justify its side effects.

Default downer

That warning rings especially true for what is considered a shining star in the nudge universe — automatic enrollment of employees in retirement savings plans. The plans, called defaults, take effect unless workers decline to participate.

No one disputes that defaults raise participation rates in retirement programs compared with traditional plans that require employees to sign up on their own. But the power of opt-out plans to kick-start saving for retirement stayed under the radar until it was reported in the November 2001 Quarterly Journal of Economics.

When the company in the 2001 study — a health and financial services firm with more than 10,000 employees — switched from voluntary to automatic enrollment in a retirement savings account, employee participation rose from about 37 percent to nearly 86 percent.

Similar findings over the next few years led to passage of the U.S. Pension Protection Act of 2006, which encouraged employers to adopt automatic pension enrollment plans with increasing savings contributions over time.

But little is known about whether automatic enrollees are better or worse off as time passes and their personal situations change, says Harvard behavioral economist Brigitte Madrian. She coauthored the 2001 paper on the power of default savings plans.

Although automatic plans increase savings for those who otherwise would have squirreled away little or nothing, others may lose money because they would have contributed more to a self-directed retirement account, Madrian says. In some cases, having an automatic savings account may encourage irresponsible spending or early withdrawals of retirement money (with penalties) to cover debts. Such possibilities are plausible but have gone unstudied.

In line with Madrian’s concerns, mathematical models developed by finance professor Bruce Carlin of the University of California, Los Angeles and colleagues suggest that people who default into retirement plans learn less about money matters, and share less financial information with family and friends, than those who join plans that require active investment choices.

Opt-out savings programs “have been oversimplified to the public and are being sold as a great way to change behavior without addressing their complexities,” Madrian says. Research needs to address how well these plans mesh with individuals’ personalities and decision-making styles, she recommends.

Story continues below graph

Delay and regret

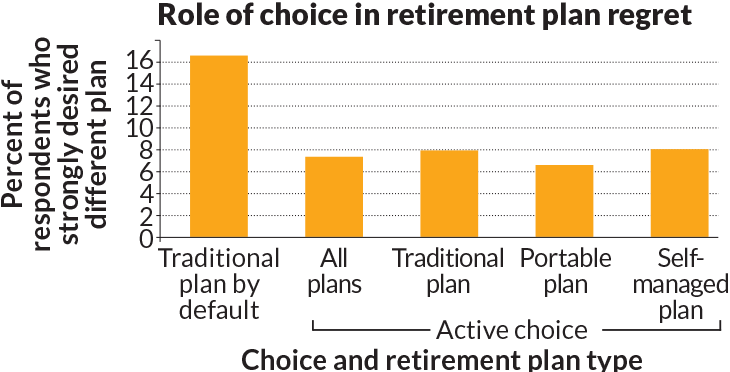

By comparing procrastinators with more decisive folks in one large retirement system, economist Jeffrey Brown examined how individual differences influence whether people join and stay happy with opt-out savings programs. Procrastinators were not only more likely to end up in a default plan but also more apt to regret that turn of events down the road, says Brown, of the University of Illinois at Urbana-Champaign.

Among state employees at the university who were offered any of three retirement plans, those who delayed making decisions were particularly likely to belong to a default plan and to want to switch to another plan, Brown and colleagues reported in September 2016 in the Journal of Financial Economics. These plans serve as a substitute for Social Security and often represent an employee’s largest financial asset. The default plan is generous toward those who stay long enough to retire from the state system but less so to those who leave early. A second plan allows for a larger cash refund upon leaving the system early. A third plan enables savers to direct contributions to any of a variety of investments. Being dumped into the default plan isn’t always the best option, especially because initial plan choices are permanent.

More than 6,000 employees who joined the retirement system in or after 1999 completed e-mail questionnaires in 2012. When asked what they would do if they could go back and redo their savings choice, 17 percent of defaulters reported a strong desire to change plans. Only about 7 percent of those who actively selected a plan and 8 percent of those who intentionally chose the default wanted to change.

The likelihood of having been assigned to the default plan and wanting to switch to another plan increased steadily as employees reported higher levels of procrastination. Implications of this finding are not entirely clear, Madrian says. Individuals in the default savings plan either by choice or procrastination may, for instance, regret lots of events in their lives. If so, they can’t easily be compared with less regretful folks who chose another plan.

Requiring people to make an active choice of a retirement plan, even if they’re procrastinators, might reduce regret down the road, Madrian suspects. But given a complex, high-stakes choice — such as that faced by Illinois university employees — “it may still make sense to set a default option even if some individuals who end up in the default will regret it later.”

Researchers need to determine how defaults and other nudges instigate behavior changes before unleashing them on the public, says philosopher of science Till Grüne-Yanoff of the Royal Institute of Technology in Stockholm.

Hidden costs

Sometimes well-intentioned, up-front attempts to get people to do what seems right come back to bite nudgers on the bottom line.

Consider e-mail prompts and reminders. Although nudges were originally conceived to encourage people to accept an option unthinkingly, simple attempts to curb forgetfulness and explain procedures now get folded into the nudge repertoire. Short-term success stories abound for these inexpensive messages. The 2016 report of the U.S. Social and Behavioral Sciences Team cites a case in which e-mails sent by the Department of Education to student-loan recipients, which described how to apply for a federal repayment plan, led 6,000 additional borrowers to sign up for the plan in the following three months, relative to borrowers who did not receive the explanatory e-mail. Messages were tailored to borrowers’ circumstances, such as whether they previously expressed interest in the payback plan or had stopped making loan repayments.

The U.K. Behavioural Insights Team — now a global company with offices in Britain, North America, Australia and Singapore — also sees value in short, informational nudges.

One of the company’s projects produced an unexpected twist. Low-income New Orleans residents who hadn’t seen a primary care physician in more than two years — 21,442 of them — received one of three text messages to set up a free medical appointment. Telling people that they had been selected for a free appointment worked best, leading 1.4 percent of recipients to sign up, versus 1 percent of those who got an information-only text. But a text asking people to “take care of yourself so you can take care of the ones you love” backfired, resulting in only 0.7 percent of recipients making appointments. Uptake for all three groups was low, but the study suggested that nudges that unwittingly trigger bad feelings (guilt or shame) can easily go awry, Aarhus University’s Damgaard says.

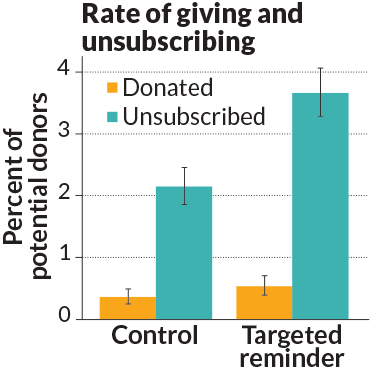

A case in point is a study submitted for publication by Damgaard and behavioral economist Christina Gravert of the University of Gothenburg in Sweden. E-mailed donation reminders sent to people who had contributed to a Danish anti-poverty charity increased the number of donations in the short term, but also triggered an upturn in the number of people unsubscribing from the list.

People’s annoyance at receiving reminders perceived as too frequent or pushy cost the charity money over the long haul, Damgaard holds. Losses of list subscribers more than offset the financial gains from the temporary uptick in donations, she and Gravert conclude.

“Researchers have tended to overlook the hidden costs of nudging,” Damgaard says.

In one experiment, more than 17,000 previous donors to a Danish charity received an e-mail asking them to donate within 10 days. About half received an additional reminder one week later. Reminders yielded 46 donations, versus 30 donations from people sent only one e-mail. But over the next month, 318 reminded donors unsubscribed from the e-mail list, as opposed to 186 of those who received one e-mail. To Damgaard and Gravert, reminders were money losers — especially if sent more than once.

A second experiment examined more than 43,000 Danish charity donors split into three groups. The number of unsubscribers reached 71 among those sent an e-mail informing them that digital reminders would be sent every month. Among those receiving the same e-mail plus an announcement that only one reminder would be sent in the next three months, 44 people abandoned the mailing list. That’s what a digital sigh of relief looks like. An e-mail that combined a notice of monthly reminders with a promise of a donation from an anonymous sponsor for every mailing list donation slightly lowered annoyance at the prospect of monthly reminders — 52 unsubscribed.

The limits of nudge

There are at least two ways to think about unintended drawbacks to nudges. Behavioral economists including Damgaard take an optimistic stance. They see value in determining how nudges work over the long haul, for better and worse. In that way, researchers can target people most likely to benefit from specific nudges. Few schemes to change behavior, including nudges, alter people’s lives for the better in a big and lasting way, cautions Harvard behavioral economist and nudge proponent Todd Rogers. “One of the most important questions in behavioral science right now is, how do we induce persistent behavior change?”

But those already critical of libertarian paternalism say that new findings back up their pessimistic view of what nudges can do. When past charity donors in Denmark fork over more money in response to an e-mail reminder and then bolt from the mailing list, as reported by Damgaard and Gravert, they’re demonstrating that even a small-scale nudge can trigger resistance, says political scientist Frank Mols of the University of Queensland in Brisbane, Australia. “It verges on ridiculous to claim that nudges can change attitudes or behavior related to huge social problems, such as crime or climate change,” he says.

Nudges wrongly assume that each person makes decisions in isolation, Mols contends. People belong to various groups that frame the way they make sense of the world, he says. Rather than nudging, lasting behavior change entails persuasion techniques long exploited by advertisers: altering how people view their social identities. Coors beer, for instance, has long been marketed to small-town folks and city dwellers alike as the choice of rugged, outdoorsy individualists.

Story continues below graph

In the noncommercial realm, Mols points to a successful 2006 campaign to reduce water use in Queensland during a severe drought. Average per capita water use dropped substantially and stayed lower after the drought broke in 2009. That’s because the campaign included advertisements targeting citizens’ view of themselves as “Queenslanders,” he says. A good Queenslander became redefined as a “water-wise” person who consumed as little of the resource as possible.

Queensland’s persuasive approach to water conservation avoided ethical concerns that dog nudges, Mols adds. Choice architects’ conviction that people possess biased minds in need of expert guidance to achieve good lives cuts off debate about what constitutes a good life, he argues.

Elspeth Kirkman, a policy implementation specialist who heads the U.K. Behavioural Insights Team’s North American office in New York City, sees no ethical problem with nudges that people can reject anytime they want. But she acknowledges that ethical gray areas exist. “It’s not always clear when an intervention is a nudge and when it’s coercive manipulation,” she says. Nudge carefully and monitor an intervention’s intended and unintended effects for as long as possible, Kirkman advises.

Even amid calls for caution, nudges are expanding their reach. With input from the Behavioural Insights Team, a U.K. law passed in March 2016 and slated to take effect in April 2018 imposes a soft drink tax that rises with increasing sugar content. The law aims to encourage soft drink companies to switch from high-sugar products to artificially sweetened and low-sugar beverages in an effort to reduce obesity. The U.K. soft drink firm Lucozade Ribena Suntory and the retail company Tesco announced last November plans to cut sugar in soft drinks by at least 50 percent to escape the looming tax.

The law might prod consumers to change too, if companies stand their ground but raise prices of high-sugar drinks due to the new tax, Kirkman predicts.

In nudges as in life, though, the best-laid plans can tank. Perhaps scientists will discover serious health risks in artificial sweeteners currently considered safe, reviving soda makers’ sugar dependence. Maybe a black market for old-school soda will pop up in Britain, sending soft drink lovers to back-alley Coke dealers for sugar fixes.

The law of unintended consequences is always taxing.

This article appears in the March 18, 2017, issue of Science News with the headline, “Nudge Backlash: Steering people’s decisions with simple tactics can come with a downside.”