Why the sale of a T. rex fossil could be a big loss for science

A dinosaur dubbed 'Maximus' is the latest in line for auction

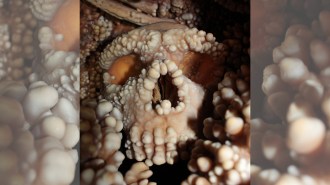

Sotheby’s auction house is putting a T. rex skull dubbed Maximus (pictured) up for auction in December. It’s expected to sell for at least $15 million.

Ted Shaffrey/Associated Press

Tyrannosaurus rex isn’t just a king to paleontologists — the dinosaur increasingly reigns over the world of art auctions. A nearly complete skeleton known as Stan the T. rex smashed records in October 2020 when a bidding war drove its price to $31.8 million, the highest ever paid for any fossil. Before that, Sue the T. rex held the top spot; it went for $8.3 million in 1997.

That kind of publicity — and cachet — means that T. rex’s value is sky-high, and the dinosaur continues to have its teeth firmly sunk into the auction world in 2022. In December, Maximus, a T. rex skull, will be the centerpiece of a Sotheby’s auction in New York City. It’s expected to sell for about $15 million.

Another T. rex fossil named Shen was anticipated to sell for between $15 million and $25 million at a Christie’s auction in Hong Kong in late November. However, the auction house pulled it over concerns about the number of replica bones used in the fossil.

“These are astronomical sums of money, really surprising sums of money,” says Donna Yates, a criminologist at Maastricht University in the Netherlands who studies high-value collectibles.

Stan’s final price “was completely unexpected,” Yates says. The fossil was originally appraised at about $6 million — still a very large sum, though nothing like the final tally, which was the result of a three-way bidding war.

But the staggering amounts of money T. rex fossils now fetch at auction can mean a big loss for science. At those prices, the public institutions that might try to claim these glimpses into the deep past are unable to compete with deep-pocketed private buyers, researchers say.

One reason for the sky-high prices may be that T. rex fossils are increasingly being treated more like rare works of art than bits of scientific evidence, Yates says. The bones might once have been bought and sold at dusty “cowboy fossil” dealerships. But nowadays these fossils are on display in shiny gallery spaces and are being appraised and marketed as rare objets d’art. That’s appealing to collectors, she adds: “If you’re a high-value buyer, you’re a person who wants the finest things.”

But fossils’ true value is the information they hold, says Thomas Carr, a paleontologist at Carthage College in Kenosha, Wis. “They are our only means of understanding the biology and evolution of extinct animals.”

Keeping fossils of T. rex and other dinosaurs and animals in public repositories, such as museums, ensures that scientists have consistent access to study the objects, including being able to replicate or reevaluate previous findings. But a fossil sold into private or commercial hands is subject to the whim of its owner — which means anything could happen to it at any time, Carr says.

“It doesn’t matter if [a T. rex fossil] is bought by some oligarch in Russia who says scientists can come and study it,” he says. “You might as well take a sledgehammer to it and destroy it.”

A desire for one’s own T. rex

There are only about 120 known specimens of T. rex in the world. At least half of them are owned privately and aren’t available to the public. That loss is “wreaking havoc on our dataset. If we don’t have a good sample size, we can’t claim to know anything about [T. rex],” Carr says.

For example, to be able to tell all the ways that T. rex males differed from females, researchers need between 70 and 100 good specimens for statistically significant analyses, an amount scientists don’t currently have.

Similarly, scientists know little about how T. rex grew, and studying fossils of youngsters could help (SN: 1/6/20). But only a handful of juvenile T. rex specimens are publicly available to researchers. That number would double if private specimens were included.

Museums and academic institutions typically don’t have the kind of money it takes to compete with private bidders in auctions or any such competitive sales. That’s why, in the month before Stan went up for auction in 2020, the Society for Vertebrate Paleontology, or SVP, wrote a letter to Christie’s asking the auction house to consider restricting bidding to public institutions. The hope was that this would give scientists a fighting chance to obtain the specimens.

But the request was ignored — and unfortunately may have only increased publicity for the sale, says Stuart Sumida, a paleontologist at California State University in San Bernardino and SVP’s current vice president. That’s why SVP didn’t issue a public statement this time ahead of the auctions for Shen and Maximus, Sumida says, though the organization continues to strongly condemn fossil sales — whether of large, dramatic specimens or less well-known creatures. “All fossils are data. Our position is that selling fossils is not scientific and it damages science.”

Sumida is particularly appalled at statements made by auction houses that suggest the skeletons “have already been studied,” an attempt to reassure researchers that the data contained in that fossil won’t be lost, regardless of who purchases it. That’s deeply misleading, he says, because of the need for reproducibility, as well as the always-improving development of new analysis techniques. “When they make public statements like that, they are undermining not only paleontology, but the scientific process as well.”

And the high prices earned by Stan and Sue are helping to drive the market skyward, not only for other T. rex fossils but also for less famous species. “It creates this ripple effect that is incredibly damaging to science in general,” Sumida says. Sotheby’s, for example, auctioned off a Gorgosaurus, a T. rex relative, in July for $6.1 million. In May, a Deinonychus antirrhopus — the inspiration for Jurassic Park’s velociraptor — was sold by Christie’s for $12.4 million.

Protecting T. rex from collectors

Compounding the problem is the fact that the United States has no protections in place for fossils unearthed from the backyards or dusty fields of private landowners. The U.S. is home to just about every T. rex skeleton ever found. Stan, Sue and Maximus hail from the Black Hills of South Dakota. Shen was found in Montana.

As of 2009, U.S. law prohibits collecting scientifically valuable fossils, particularly fossils of vertebrate species like T. rex, from public lands without permits. But fossils found on private lands are still considered the landowner’s personal property. And landowners can grant digging access to whomever they wish.

Before the discovery of Sue the T. rex (SN: 9/6/14), private owners often gave scientific institutions free access to hunt for fossils on their land, says Bridget Roddy, currently a researcher at the legal news company Bloomberg Law in Washington, D.C. But in the wake of Sue’s sale in 1997, researchers began to have to compete for digging access with commercial fossil hunters.

These hunters can afford to pay landowners large sums for the right to dig, or even a share of the profits from fossil sales. And many of these commercial dealers sell their finds at auction houses, where the fossils can earn far more than most museums are able to pay.

Lack of federal protections for paleontological resources found on private land — combined with the large available supply of fossils — is a situation unique to the United States, Roddy says. Fossil-rich countries such as China, Canada, Italy and France consider any such finds to be under government protection, part of a national legacy.

In the United States, seizing such materials from private landowners — under an eminent domain argument — would require the government to pay “just compensation” to the landowners. But using eminent domain to generally protect such fossils wouldn’t be financially sustainable for the government, Roddy says, not least because most fossils dug up aren’t of great scientific value anyway.

There may be other, more grassroots ways to at least better regulate fossil sales, she says. While still a law student at DePaul University in Chicago, Roddy outlined some of those ideas in an article published in Texas A&M Journal of Property Law in May.

One option, she suggests, is for states to create a selective sales tax attached to fossil purchases, specifically for buyers who intend to keep their purchases in private collections that are not readily available to the public. It’s “similar to if you want to buy a pack of cigarettes, which is meant to offset the harm that buying cigarettes does to society in general,” Roddy says. That strategy could be particularly effective in states with large auction houses, like New York.

Another possibility is to model any new, expanded fossil preservation laws on existing U.S. antiquities laws, intended to preserve cultural heritage. After all, Roddy says, fossils aren’t just bones, but they’re also part of the human story. “Fossils have influenced our folklore; they’re a unifier of humanity and culture rather than a separate thing.”

Though fossils from private lands aren’t protected, many states do impose restrictions on searches for archaeological and cultural artifacts, by requiring those looking for antiquities to restore excavated land or by fining the excavation of certain antiquities without state permission. Expanding those restrictions to fossil hunting, perhaps by requiring state approval through permits, could also give states the opportunity to purchase any significant finds before they’re lost to private buyers.

Preserving fossils for science and the public

Such protections could be a huge boon to paleontologists, who may not even know what’s being lost. “The problem is, we’ll never know” all the fossils that are being sold, Sumida says. “They’re shutting scientists out of the conversation.”

And when it comes to dinosaurs, “so many of the species we know about are represented by a single fossil,” says Stephen Brusatte, a paleontologist at the University of Edinburgh. “If that fossil was never found, or disappeared into the vault of a collector, then we wouldn’t know about that dinosaur.”

Or, he says, sometimes a particularly complete or beautifully preserved dinosaur skeleton is found, and without it, “we wouldn’t be able to study what that dinosaur looked like, how it moved, what it ate, how it sensed its world, how it grew.”

The point isn’t to put restrictions on collecting fossils so much as making sure they remain in public view, Brusatte adds. “There’s nothing as magical as finding your own fossils, being the first person ever to see something that lived millions of years ago.” But, he says, unique and scientifically invaluable fossils such as dinosaur skeletons should be placed in museums “where they can be conserved and studied and inspire the public, rather than in the basements or yachts of the oligarch class.”

After its record-breaking sale, Stan vanished for a year and a half, its new owners a mystery. Then in March 2022, news surfaced that the fossil had been bought by the United Arab Emirates, which stated it intends to place Stan in a new natural history museum.

Sue, too, is on public view. The fossil is housed at Chicago’s Field Museum of Natural History, thanks to the pooled financial resources of the Walt Disney Corporation, the McDonald Corporation, the California State University System and others. That’s the kind of money it took to get the highest bid on a T. rex 25 years ago.

And those prices only seem to be going up. Researchers got lucky with Sue, and possibly Stan.

As for Shen, the fossil’s fate remains in limbo: It was pulled from auction not due to outcry from paleontologists, but over concerns about intellectual property rights. The fossil, at 54 percent complete, may have been supplemented with a polyurethane cast of bones from Stan, according to representatives of the Black Hills Institute of Geological Research in Hill City, S.D. That organization, which discovered Stan, retains a copyright over the skeleton.

In response to those concerns, Christie’s pulled the lot, and now says that it intends to loan the fossil to a museum. But this move doesn’t reassure paleontologists. “A lot of people are pleased that the sale didn’t go through,” Sumida says. “But it sort of just kicks the can down the road.… It doesn’t mean they’re not going to try and sell it in another form, somewhere down the road.”

Ultimately, scientists simply can’t count on every important fossil finding its way to the public, Carr says. “Those fossils belong in a museum; it’s right out of Indiana Jones,” he says. “It’s not like they’re made in a factory somewhere. Fossils are nonrenewable resources. Once Shen is gone, it’s gone.”